If you complete an approved homebuyer education course you may qualify for a closing cost credit when you make an eligible down payment of 3 to 5 on a fixed rate loan.

Wells fargo home refinance no closing costs.

Taxes and or utilities that are prepaid by the seller.

Understand the costs of refinancing.

Changes to pricing caused by interest rate changes changes to your credit or income etc.

If your new loan has the same term as your original mortgage you may end up paying more interest over the long run.

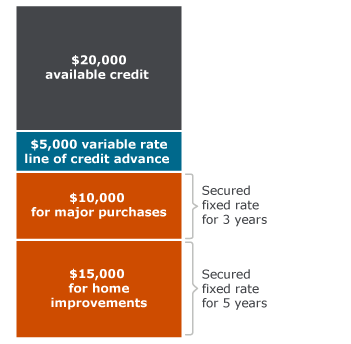

When you close on your loan you ll get funds you can use for other purposes.

You may be able to use monetary gifts from family for all or a portion of your closing costs.

Refinancing replaces your existing loan with a new one.

Closing costs can be paid by you the home seller or the lender.

Use our mortgage payment calculator to find your rate.

A simplified online application makes it easier to apply for home loan refinancing with wells fargo.

The price and value of your home and the amount of your home loan where you live since closing costs vary by region.

You ll have to pay closing origination and other loan fees.

A cash out refinance lets you access your home equity by replacing your existing mortgage with a new one that has a higher loan amount than what you currently owe.